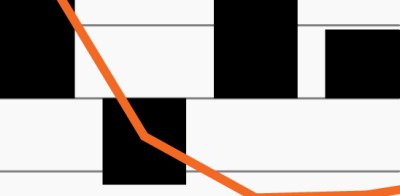

Stocks and Treasury yields move in opposite directions

Source: Federal Reserve Bank of St. Louis, as of October 29, 2020.

- The 10-year U.S. Treasury yield has quietly begun to climb higher in recent months, pressuring bond prices in the process. Treasuries’ recent rise seems to have been driven by growing speculation that a Biden administration, if elected, might pass additional fiscal stimulus measures along with greater infrastructure spending.

- Yet the 10-year’s move since early September has been particularly notable as it has reversed the trend of stocks plowing ahead through much of the year while Treasury yields remained anchored near rock-bottom levels. Rates have moved higher (and bond prices lower) despite significantly more caution taking over equity markets.

- Treasury yields showed their recent resilience this week, moving slightly higher through Thursday, while the S&P 500 was down nearly -5%. With stocks under duress like this, investors normally might flee to the safety of Treasuries, sending their yields lower and pushing prices higher on traditional bonds.1 Gold, another traditional hedge against equity volatility, also moved lower this week, declining approximately -1.3%.1

- We’ve noted before the difficult position that traditional bonds are in today. They continue to offer little income even as rates seem to have taken a sustainable step up from their lows this summer. At the same time, duration risk for many core fixed income allocations is elevated, leading to potentially greater losses should rates rise further.

- Within today’s environment, investors may seek opportunities in investments such as high yield bonds or senior secured loans whose performance has historically been uncorrelated to interest rate changes.