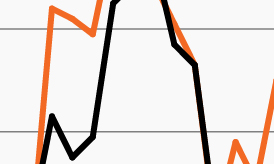

CRE valuations during COVID vs. GFC

Source: Real Capital Analytics (RCA), NCREIF, Macrobond, FS Investments, as of December 31, 2020. The RCA Commercial Property Price Index (CPPI) employs a transaction-based formula to gauge changes in property values while the NCREIF measures changes based on appraisals of property prices.

- The Fed’s January 2021 survey of senior loan officers highlighted a renewed sense of optimism in the commercial real estate (CRE) market as demand for CRE loans jumped from a quarter earlier. In fact, despite the ongoing pandemic and economic recession, major CRE valuation gauges have remained impressively resilient.

- The chart shows the performance of two indexes that track commercial real estate, the National Council of Real Estate Investment Fiduciaries (NCREIF) Index and the RCA Commercial Property Price Index (CPPI), around the current recession and the Global Financial Crisis (GFC) of 2008–09.

- Both indexes faced sustained and significant declines during the GFC, as would be expected given that CRE property prices generally experience weakness during recessions. Just as it has been in so many ways, however, the COVID crisis is turning out to be an exception to the rule, as both indexes held firm in 2020 and even began to move higher.1

- Looking at 2020 performance data without context, one might ask whether there was a recession at all. Instead, CRE prices have been supported by a combination of 1) a lack of distressed sales, 2) massive fiscal stimulus measures, and 3) significant investor demand for CRE assets in the face of historically low yields across many asset classes.

- The CRE market’s resilience amid COVID has been a welcome surprise. Unlike during the GFC, however, it has minimized investors’ potential to “buy the dip” and potentially upended the normal CRE investment cycle. With investors focused on how the use case for different property types has changed, the next market cycle could look very different from the last.