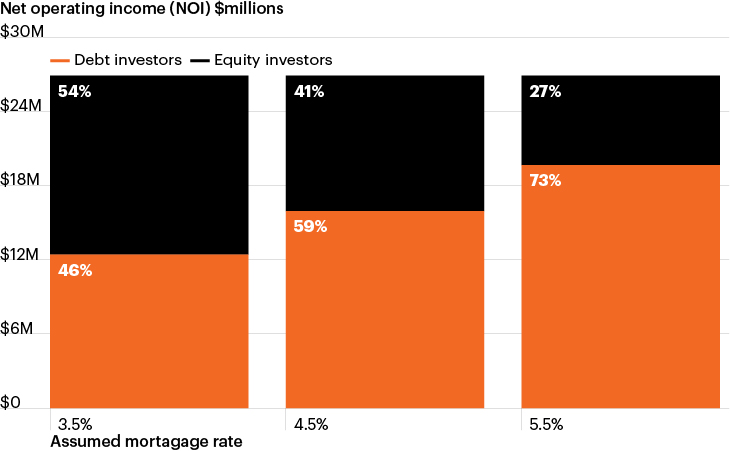

Hypothetical % of a property’s net operating income received based on investor type over a 5-year hold period

Source: FS Investments. Example shows a hypothetical $100 million property with a 5% cap rate, 67% net operating income margin and 3% annual operating expense growth financed at a 70% loan to value ratio with an interest-only loan and held for five years.

- Rising rates amid persistent inflationary pressures have presented extraordinary challenges to investors this year resulting in steep declines in the equity and fixed income markets.

- Commercial real estate (CRE) prices have been noticeably less volatile, yet price growth, while positive across all major property types year over year, has slowed as rising rates pressure valuations and create a broadening divide between buyers and sellers.

- While slowing price growth implies potentially lower total returns for equity investors, it may also highlight the benefits of senior secured CRE debt in the current environment.

- As the chart shows, CRE debt investors capture significantly more of the income generated by a property, as interest rates and mortgage rates increase (for a given cap rate and level of rent growth).The 2-year Treasury yield began the year within shouting distance of its all-time low of 0.78% but has since reached a 15-year high of 4.15%.

- In this example, debt investors would capture 46% of cash flow generated over a five-year period when the mortgage rate is 3.5% compared to 73% at a 5.5% mortgage rate.1 (Read more in our Q4 2022 CRE Outlook: Recalibration in Progress.)

- While CRE equity remains an important element to a broadly diversified portfolio, investors may be wise in tilting their portfolio toward CRE debt amid today’s rising rate environment and cloudy economic outlook.