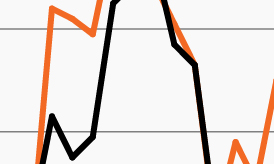

Growth of $100,000 during the global financial crisis

Past performance is not indicative of future results. CRE debt is subject to heightened credit risk, particularly during periods of economic stress.

Source: Bloomberg Finance, L.P., FS Investments, for the four-year period ended March 31, 2011. CRE debt is represented by the Giliberto-Levy Commercial Mortgage Performance Index. The Agg refers to the Bloomberg U.S. Aggregate Bond Index. CRE property prices are represented by the RCA Commercial Property Price Index.

- Debate about a potential recession in the U.S. has picked up steam recently over concerns that an overly aggressive Fed tightening cycle may lead to a more significant pullback in consumer and business demand.

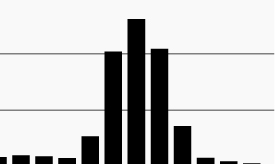

- As investors recalibrate their forward return expectations, the traditional 60/40 portfolio is down -16.7% year to date as stocks and bonds have sold off in unison.1

- Amid the market turmoil, commercial real estate (CRE) debt has seen a significantly smaller drawdown. The Giliberto-Levy Commercial Mortgage Performance Index, which tracks the performance of fixed-rate, 7–10-year commercial mortgages held on institutional lenders’ balance sheets, returned -4.41% through Q1, as it benefited from a still solid backdrop for CRE investments.

- In fact, CRE debt has performed well during historical periods of economic softness or recession. This week’s chart looks at its performance through the global financial crisis (GFC). As it shows, the S&P 500 declined nearly -50% in late 2007 while commercial real estate property prices fell more than 30%.2 CRE debt (orange line) fared significantly better with a modest drawdown during the GFC.2

- Clearly, no two downturns are exactly alike. The GFC was a real estate-driven decline in which the Fed quickly lowered rates to rock bottom levels compared to today’s tightening cycle where real estate fundamentals remain generally strong. Amid today’s uncertain outlook, CRE debt’s seniority in the capital structure (paid ahead of property owners) may be a timely portfolio solution given its historical track record of weathering through economic stress.