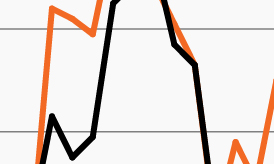

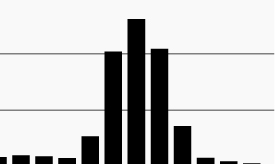

Giliberto-Levy loan performance

Source: FS Investments, Giliberto-Levy Commercial Mortgage Performance Index. As of February 28, 2023.

- Much ink has been spilled this year on the lackluster performance of stocks and bonds. The 60/40 portfolio has returned –11.7% this year, driven in large part by the failure of traditional fixed income to serve its historical role as a hedge to falling stock prices.1 Indeed, the Bloomberg U.S Aggregate Index is down -9.2% year to date.

- As the forward return outlook for traditional fixed remains challenged, this week we highlight commercial real estate (CRE) debt, an asset class that may serve as an alternative source of income and portfolio diversification.

- The chart shows the return breakdown of the Giliberto-Levy Commercial Mortgage Performance Index, which tracks the performance of commercial mortgages held on institutional lenders’ balance sheets.

- Income has been the primary driver of returns for the asset class with mild credit losses – even during the depths of the Great Financial Crisis. As the chart shows, credit losses experienced during the crisis were more than offset by income and commercial mortgages have generated positive net returns going back to 2007.

- While we recognize a slowing economy may impact real estate valuations, fundamentals across the CRE market today remain generally healthy. CRE property prices rose nearly 18% year over year in April while transaction volume remains firm.2 Meanwhile, the delinquency rate on commercial mortgage-backed securities, another large source of debt capital for CRE borrowers, continues to decline from the COVID highs, hitting 3.14% in May.3

- The CRE market’s strength could be put to the test in the second half of 2022 as mortgage rates rise. Against this backdrop, floating rate CRE debt may be an attractive place for investors given its higher place in the capital structure and historical ability to weather varying rate and macro environments.