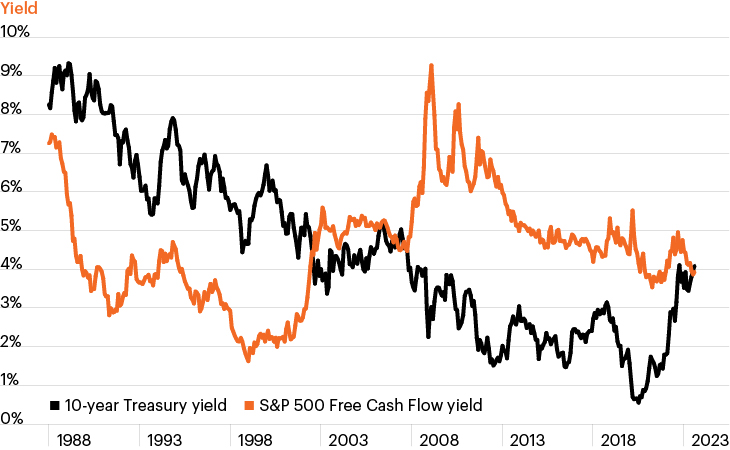

Relative yields, U.S. equity market vs. Treasuries

Source: Bloomberg Finance, L.P., as of August 31, 2023.

- Comparing equity yields to those available on risk-free bonds is a common way for analysts to decipher the level of excess return investors demand to assume equity market risk—that is, the equity risk premium.

- One way to measure equity yield is the free cash flow (FCF) yield, which is a valuation metric comparing FCF generated over the past 12 months to current equity prices. As the chart shows, the U.S. large cap FCF yield is about equal to the 10-year U.S. Treasury yield.

- It is important to stress that because equity FCF grows—sometimes quite substantially—over most periods while bond coupons remain static, this is not a perfect relationship. During the 1980s and 1990s, Treasuries yielded significantly more than equities, while in the 2010s the opposite was true.

- However, the relationship can be a useful way to gauge investors’ overall sentiment toward risk-taking. Economic skepticism throughout the 2010s kept yields on equities persistently higher than those on bonds, even as U.S. tech firms produced impressive margins.

- Today’s equity yield suggests enhanced earnings growth expectations and an abatement in skepticism around the economy. While many investors have been counting on the Fed engineering a soft landing, the equity risk premium does not appear to be sufficiently compensating investors for the material risks still present in the current economic backdrop.