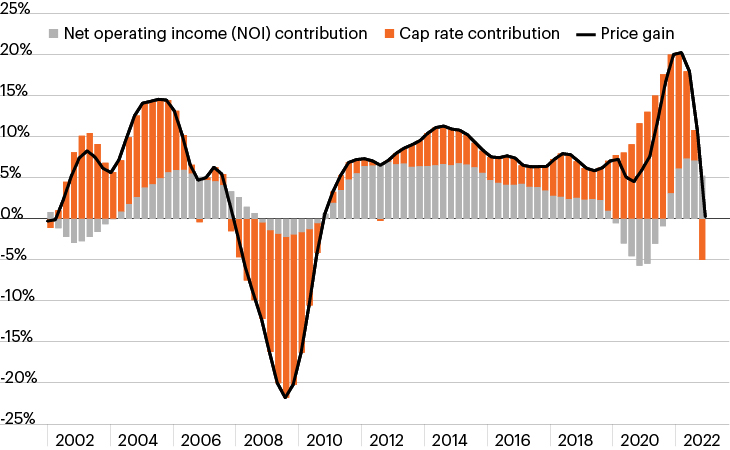

Attribution of CRE property price growth

Source: MCSI Real Capital Analytics, as of December 31, 2022. Latest data available.

- Since the global financial crisis (GFC), the commercial real estate (CRE) market generally enjoyed a period of solid price appreciation, driven by steady economic growth and low interest rates.

- Falling cap rates, which steadily declined amid the extended low- or zero-interest rate environment, accounted for a meaningful amount (56%) of total CRE price growth since 2011.1 Since January 2020, cap rates drove for virtually all CRE property price growth amid the Fed’s prevailing zero-interest rate policy.1

- The rising rate environment in 2022, however, began to usher in a significant change in the makeup of CRE returns.

- As the chart shows, cap rates’ contribution to price growth declined in Q3 2022 and meaningfully detracted from it in Q4. Over the same time frame, income has represented a growing percentage of price growth.

- With peak Fed hawkishness still not yet in sight, the economics supporting CRE price growth could remain challenging. However, declining CRE property values highlight the potential benefits of CRE debt, as income will likely represent a greater percentage of total return in the coming months. Importantly, debt markets remain on solid footing as lenders have generally kept in place the conservative approach they adopted during the GFC.