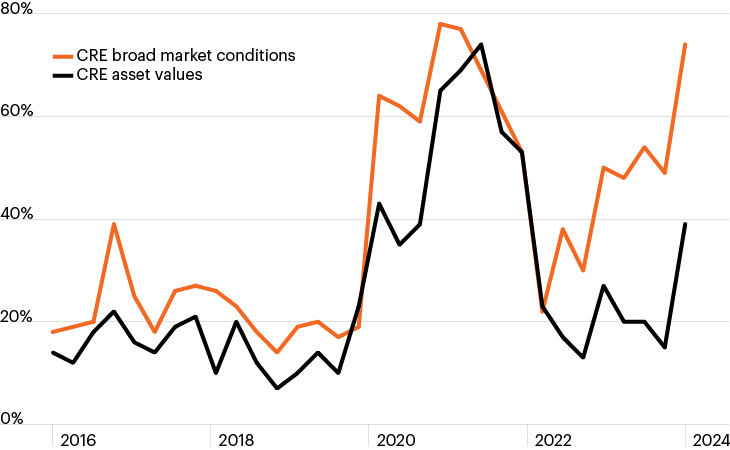

Real Estate Roundtable survey: Percent who say conditions will be better in one year

Source: The Real Estate Roundtable, via Macrobond as of Q1 2024.

- Following one of the more challenging years for commercial real estate (CRE) investors since the Global Financial Crisis, 2024 brings with it a new sense of hope.

- Activity and property values remain depressed, but the pace of the correction slowed over the past two quarters. In addition, the chart highlights improved sentiment among senior real estate professionals (based on quarterly surveys conducted by the Real Estate Roundtable).

- Survey participants are optimistic compared to a year ago, but the chart also highlights a notable gap, with 74% of survey participants expecting general CRE conditions to improve over the next year (orange line), while only 39% (black line) believing asset values will be higher.1

- Said another way, senior CRE professionals seem to accept that the market is stabilizing and healthier today following the interest rate-driven challenges of the past year. But they also believe it could take some time before property prices turn higher.

- A fundamentally healthy CRE market with modest price growth, as expected by many senior CRE executives, may prove disappointing for investors accustomed to significant levels of capital appreciation in real estate. Yet it would be an ideal environment for lenders to CRE sponsors seeking attractive yield potential and income growth.