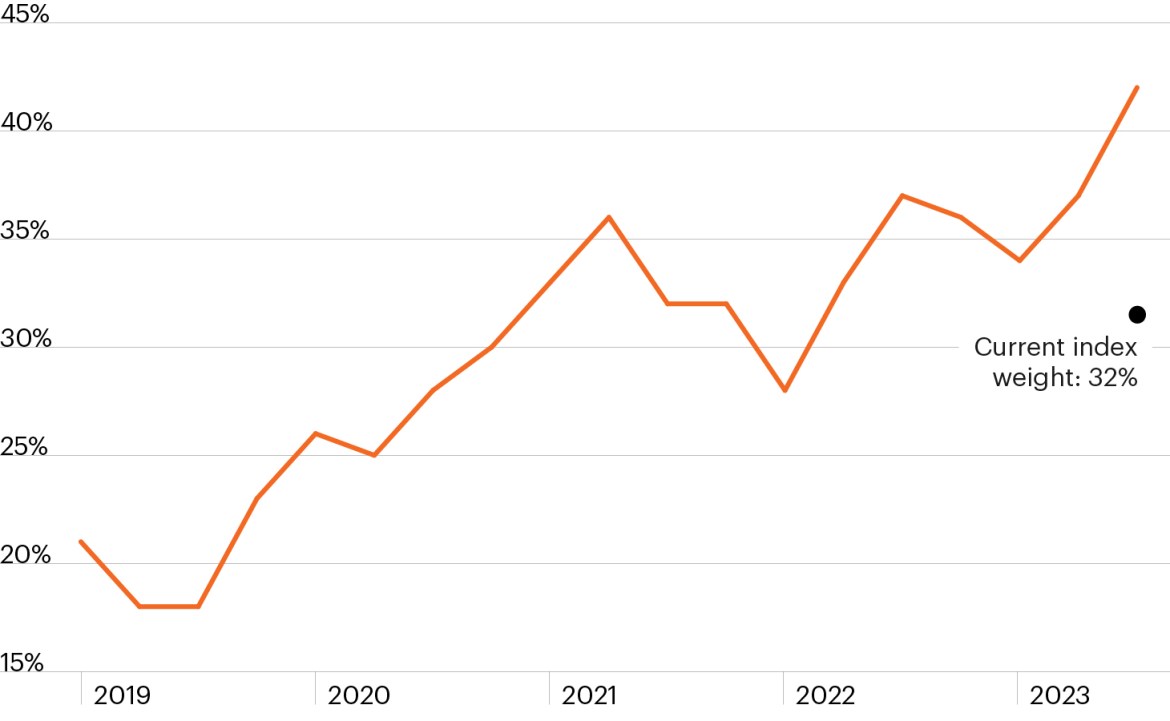

Magnificent 7 contribution to S&P 500 monthly volatility

Source: Bloomberg Finance, L.P., as of May 31, 2024. Magnificent Seven includes MSFT, AAPL, AMZN, META, NVDA, TSLA and GOOG.

- Major equity indices hit new all-time highs this week, highlighting stocks’ strong run over the past 18 months. Despite markets’ notable optimism, investors continue to wrestle with potentially challenging allocation decisions given the current macro backdrop.

- Stock-bond correlations are at a 40-year high, calling into question bonds’ reliability as a portfolio ballast against volatile equity markets.1 Core fixed income in particular has struggled amid significant rate volatility, returning -0.17% over the past five years.2

- Additionally, investing in the S&P 500 increasingly implies a concentrated bet on the Magnificent 7, an inescapable group of massive U.S. tech and tech-related firms.

- The Mag 7’s weighting in the S&P 500 has skyrocketed over the past decade, eclipsing 30% today and, as the chart shows, its contribution to the index’s risk is also meaningfully higher (42%).1

- Against a backdrop of historically high stock-bond correlations and historically high concentration within the equity market, it is increasingly important to find alternative sources of diversification.