As markets adjust to the most aggressive rate hike cycle since the early 1980s, CRE mortgage rates are feeling the impacts. What does this shift to higher financing costs mean for investors? We evaluate CRE fundamentals amid a new backdrop and explore why investors might consider a shift in focus from CRE equity to debt in our latest research note.

Key takeaways

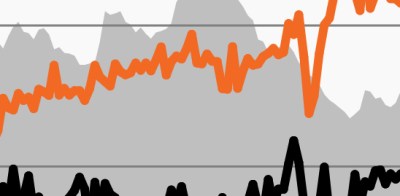

- CRE mortgage rates are rising significantly as the Fed acts aggressively to combat inflation. This follows a two-year period during which record-low rates helped drive annual property price gains near 20%.

- Market fundamentals are solid, and we believe most sectors appear resilient even in the face of an economic deceleration.

- Higher financing costs act to shift income from property owners to lenders, altering the risk-return balance in favor of debt over equity, in our view.