The 10-year U.S. Treasury yield recently breached the 3% mark and is currently sitting at multi-year highs. At around 3.15%, the yield remains low by historical standards, but the recent rise should give investors pause.1 With interest rates still well below their long-term average, now might be a good time for investors to reassess the risks of a traditional fixed income portfolio.

Traditional fixed income portfolio yields’ recent fall

Amid a three-decade bull market for bonds, fixed income investors could generally rely on a “core bond” strategy to meet their dual objectives of generating income and preserving capital. Benchmarked to the Bloomberg Barclays U.S. Aggregate Bond Index (Barclays Agg), a traditional fixed income portfolio typically included a mix of Treasuries, municipal bonds, investment grade corporate bonds and mortgage-backed securities.

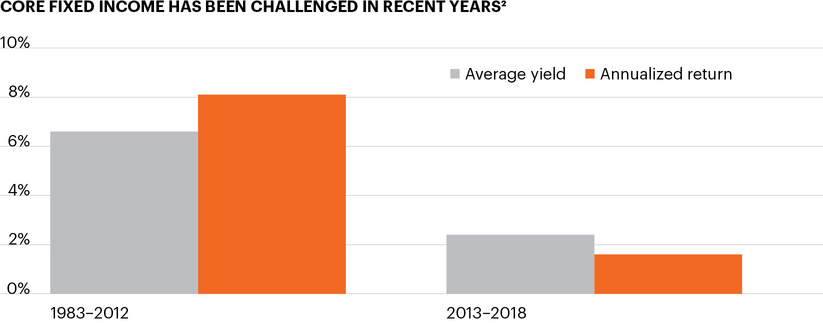

Between 1983 and 2012, these types of investments produced relatively strong performance. Over the past five years, however, traditional fixed income investments have not delivered the same levels of income and returns. Whereas the Barclays Agg had an average yield of 6.6% and generated an annualized return of 8.1% between 1983 and 2012, over the past five years the index yielded only 2.4% on average and generated an annualized return of just 1.6%.2

Why duration matters when interest rates rise

While traditional fixed income investments typically carry little in the way of credit risk and are generally perceived as safe investments, their performance can suffer during times of changing interest rates. Duration is the most common metric used to gauge a bond’s sensitivity to changes in rates. The higher a bond’s duration, the higher its sensitivity to changing interest rates.

The duration of a traditional fixed income portfolio has been on the rise for over a decade.3 At six years, the Barclays Agg’s effective duration is almost double what it was a decade ago.3 This relatively high sensitivity to rising interest rates, combined with the benchmark’s relatively low yield, has resulted in significantly more modest returns for investors’ core bond allocations over the past five years.

Given the potential for securities that typically make up a core bond strategy to decline in value if interest rates rise, investors should be especially alert to this type of risk given today’s market environment. As the yield on the 10-year U.S. Treasury note rose from 2.4% to 3.1% through the first nine months of 2018, the Barclays Agg has generally underperformed, returning -1.6%.3

Income opportunities in today’s market

So, where can fixed income investors turn? There is a broad $6.5 trillion opportunity beyond the core fixed income opportunity set that may help generate an attractive level of income and higher total returns while helping manage interest rate risk.4

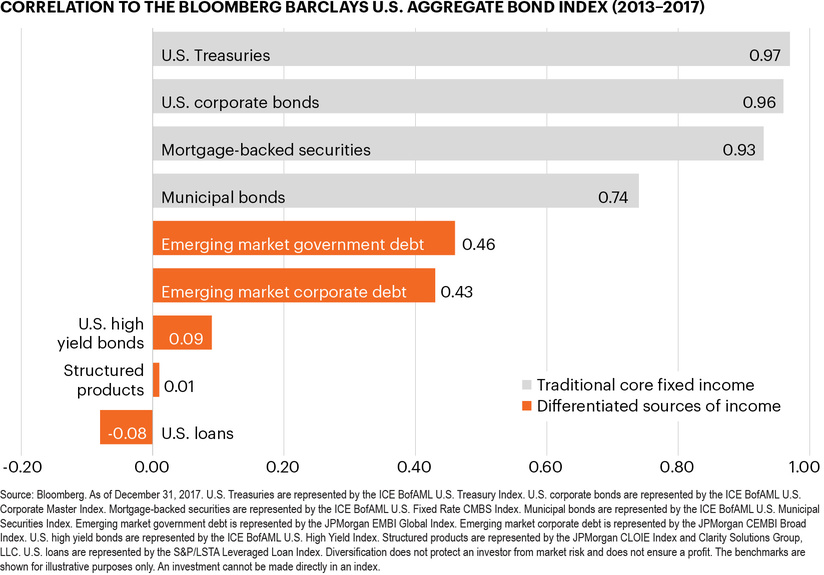

Fixed income sectors such as high yield bonds, emerging market debt and senior secured loans may serve to complement a traditional core fixed income portfolio. Allocating to these sectors may help diversify a traditional bond portfolio and provide differentiated sources of income.

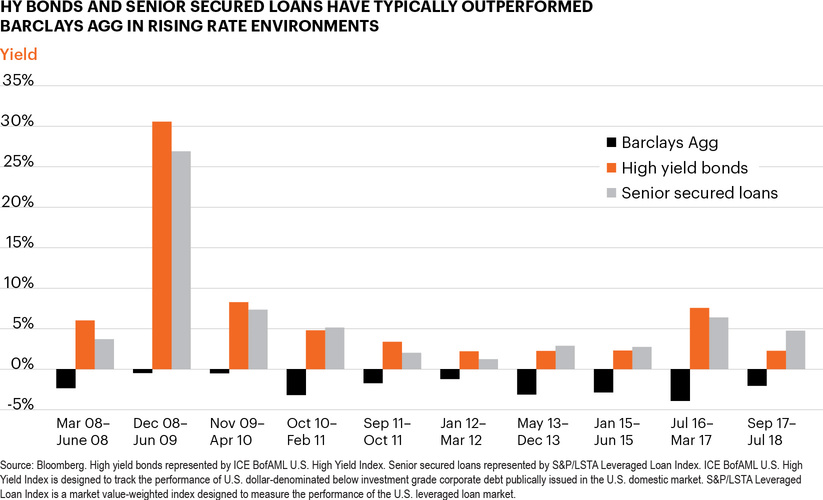

Higher Treasury yields often coincide with periods of economic expansion, rising corporate earnings and generally stable company fundamentals – environments supportive of lower-duration, credit-sensitive investments. As the chart shows, high yield bonds and senior secured loans have typically outperformed the Barclays Agg during periods of rising rates.

Notably, the recent move in the 10-year U.S. Treasury note has produced a similar dynamic. High yield bonds and senior secured loans have both generated positive returns through the first part of 2018 due, in large part, to their generally low durations, higher coupons and negative correlation to U.S. Treasuries.5,6

If history is any guide, investments with lower durations, such as high yield bonds and senior secured loans, may help provide income and manage volatility should U.S. Treasury yields continue to rise from current levels. As a result, a prudent approach may be diversifying a fixed income portfolio to include investments with higher yields and lower correlations to the Barclays Agg.