More of our insights

Showing 79–84 insights out of 156 results

Chart of the week

Small caps show signs of economic stress?

This week’s chart looks at the rising percentage of small cap companies reporting negative earnings as public index returns mostly remain in neutral.

Chart of the week

Inflation data drives market volatility

As the market remains focused on inflation, this week’s chart looks at S&P returns on days when CPI is released compared to non-release days.

Strategy note

“Dare to Dream” part III—How multi-strategy funds could benefit from an optimistic scenario

A new strategy note from Chief Market Strategist Troy Gayeski

Chart of the week

The Agg headed for a third consecutive annual decline?

This week’s chart looks at the Agg’s recent performance as rising rates provide a formidable headwind for core fixed income.

Chart of the week

Concentrated equity market persists in 2023

This week’s chart looks at the massive divide between year-to-date returns on the Big 7 tech stocks and the rest of the S&P 500.

Chart of the week

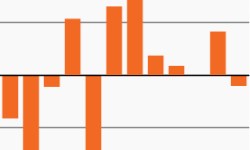

Recession or not, equity return backdrop is challenged

Stocks have seen strong year-to-date (YTD) returns, but high valuations portend challenges ahead as this week’s chart shows.

Showing 79–84 insights out of 156 results