More of our insights

Showing 85–90 insights out of 162 results

Chart of the week

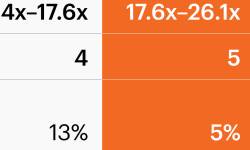

Recession or not, equity return backdrop is challenged

Stocks have seen strong year-to-date (YTD) returns, but high valuations portend challenges ahead as this week’s chart shows.

Podcast

FireSide: Economy, markets and Taylor Swift

Taylor Swift and the era for alts. What the pop phenomenon tells us about asset allocation, private equity and alternative investments.

Chart of the week

Private markets attractive in market drawdowns?

This week’s chart looks at private markets’ relatively small declines during the past two market drawdowns compared to their public counterparts.

Chart of the week

Stock-bond correlation is quickly rising

Stock-bond correlation has been on the rise again. This week’s chart looks at the trend and how it has exacerbated the diversification challenge.

Podcast

3D Report: Q2 2023 Recap—An exuberant upside surprise

Ryan Caldwell and Lara Rhame review the 3D Report for Q2 2023.

Chart of the week

In 2023, the Agg has seen little bounce-back

The Agg has lost steam with three consecutive monthly declines. This week’s chart tracks its monthly returns against the 10-year yield.

Showing 85–90 insights out of 162 results