More of our insights

Global fixed income plummets as policy tightens

As policymakers reset rate expectations, this week’s chart looks at falling performance across the U.S. and Global Agg Indexes.

Credit market commentary: July 2022

There was a remarkable rally last month as second quarter earnings results were better than feared and markets appear unconvinced that the Fed will be able to hike rates as aggressively going forward, especially given signs of a slowing economy.

Q3 2022 Corporate credit outlook: Quality time

Join Head of Investment Research Rob Hoffman as he outlines his thoughts on areas of opportunity in credit markets for second half of 2022.

As investors seek quality, broadly syndicated loans wilt

As investors seek higher quality investments, this week’s chart looks at the loan market’s gradual move down in quality.

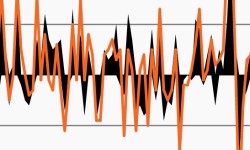

Unrelenting inflation has exaggerated rate volatility

This week’s chart looks at daily yield changes on 2-year and 10-year Treasury yields as rate volatility in 2022 has dwarfed that of last year.

Q3 2022 Corporate credit outlook: Quality time

Despite the pain felt by higher quality portfolios in the first half of 2022, we believe quality in credit markets will matter again in the back half of the year.