More of our insights

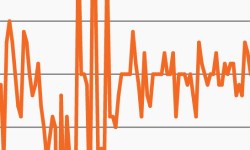

Rate volatility returns in a big way, joining stocks

Short rates saw their largest jump in more than year. Our chart focuses on elevated rate volatility this year as equity markets also remain choppy.

The secular opportunity for CLOs

Chief Market Strategist Troy Gayeski tackles the topic of CLO mezzanine debt and its potential benefits in a yield-starved environment, both present day and for the long run.

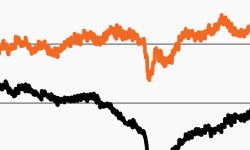

Investment grade bonds vulnerable as rates rise

As rising rates have wreaked havoc across markets this year, our chart focuses on the widening duration gap between IG and HY bonds.

Q1 2022 Corporate credit outlook

The solid backdrop for credit sets the scene for compelling returns. It will be a credit-picker’s market, and we look to high yield bonds and senior secured loans as areas of continued opportunity.

Credit market commentary: December 2021

Credit markets were positive in December. After two straight monthly declines, HY bonds posted their best month of the year, up 1.88%, while loans returned 0.64%.

5 for ’22: Corporate credit

We continue our outlooks for 2022 and talk corporate credit markets with Head of Investment Research, Rob Hoffman.