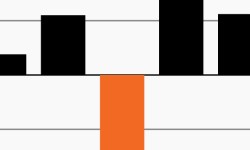

Stock and bond volatility jump together

Volatility has escalated this year across stock and bond markets. This week’s chart looks at daily changes in the S&P 500 and the Agg.

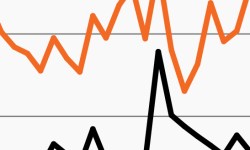

A battle emerges between sentiment and earnings

Eroding sentiment has driven markets down, yet fundamentals remain firm. This week’s chart looks at the divergence, why it could drive volatility.

Treasury and equity volatility reach recent peaks

Markets have been choppy and there could be more to come. This week’s chart looks at recent rises in expected equity and Treasury volatility.

Investors bracing for a potential policy mistake?

Investors expecting rapid rate hikes, followed by a quick reversal? Our chart looks at market expectations for a possible policy mistake.

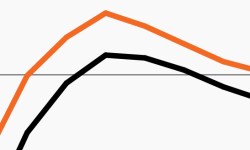

Real yields rise to usher in new market dynamics?

After two years in negative territory, real yields are back to zero. Our chart looks at real yields impact on growth and value stocks.

Already vulnerable, the 60/40 appears deeply challenged

The 60/40 had its worst quarter since the pandemic started. Our chart looks at quarterly returns and why the coming quarters could remain volatile.