Education > Strategies > Private equity > A further look at private equity

A further look at private equity

Learn more about why this asset class may make sense for your portfolio

What are the primary private equity strategies?

Private equity investment strategies

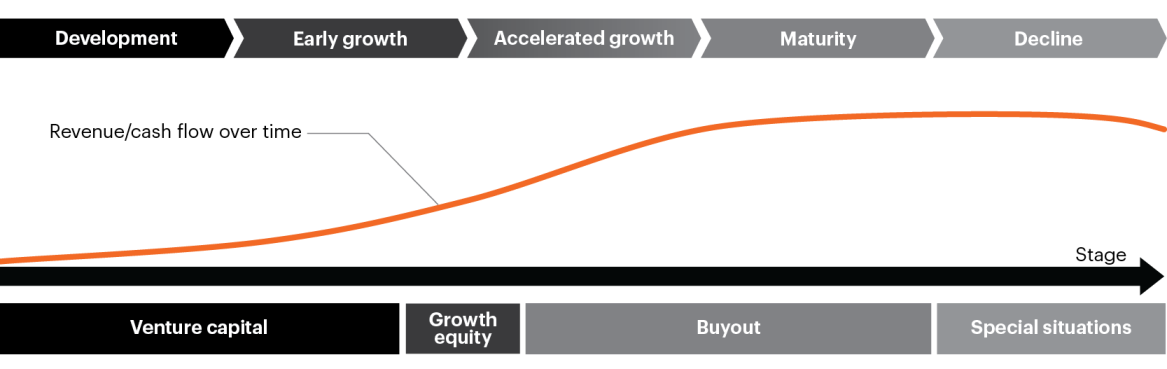

Private equity includes a range of investment strategies that correspond to a specific stage of a company’s life cycle from early-stage venture capital to later-stage buyouts and special situations.

Stages of investment along the business cycle

Private equity landscape in the business cycle framework

For illustrative purposes only.

Source: Mercer “Understanding Private Equity, A Primer” September 2015.

Venture capital

Investments in new and emerging companies, often in technology, health care or other high growth industries. Companies financed by venture capital are generally not cash flow positive at the time of investment and may require several rounds of financing before the company can be sold privately or taken public. Venture capital investors may finance companies along the full path of development or focus on certain sub‐stages (usually classified as seed, early and late stages) in partnership with other investors. Venture capital funding rounds are often serialized as Series A, B, C, etc.

Growth capital

Growth capital sits between the venture capital and buyout strategies and may exhibit characteristics of each. Investors typically take a minority or non-controlling stake in companies they believe will grow rapidly. These companies may be profitable and are often relatively mature compared to venture capital but are generally less mature than the companies targeted in buyouts.

Buyout

This strategy describes controlling investments in established companies with positive cash flow. Buyout strategies may focus on small‐, mid‐ or large‐capitalization companies, and are typically financed through a combination of equity capital from a private equity sponsor and borrowings at the portfolio company (i.e., the company being acquired issues debt, which is then used by the private equity fund to purchase all or a portion of the company from its previous owners). May also be referred to as “leveraged buyouts” or “LBOs.”

Special situations

This category includes a broad range of strategies typically involving a company experiencing financial stress or a significant change in its operations. At this stage of the business cycle, an investor may help provide capital and operational expertise to restructure a company’s balance sheet, inject new capital or otherwise help turnaround the company’s performance.

How are private equity funds typically structured?

Most private equity funds are structured as closed-end investment vehicles and are organized as a limited partnership, with two key parties, the general partner and limited partners.

General partner (GP): The fund manager who raises capital from investors, and sources, executes, and manages investments to generate returns for the investors.

Limited partners (LPs): Investors in a private equity fund, which have historically been large institutions such as pension funds, endowments and sovereign wealth funds as well as high net worth individuals.

The terms of the partnership are documented in a limited partnership agreement (LPA), which outlines the roles and obligations of each party, the duration of the fund and fund terms.

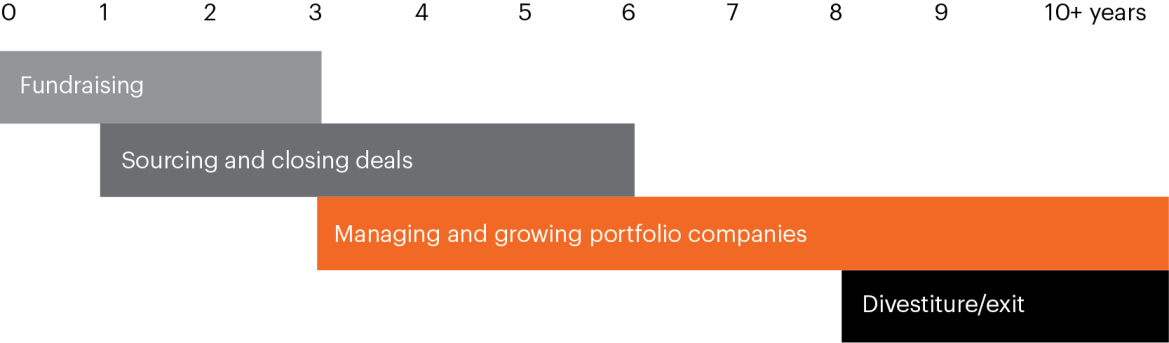

The private equity life cycle

Private equity funds generally have a 10-year life span depending on how quickly the manager raises capital, sources and exits investments, and returns capital to investors.

Illustrative life cycle of a private equity fund

Definitions

Investment period: The first four to five years of a private equity fund’s life is known as its “investment period.” During this time, the GP sources and evaluates potential investments, conducts business and valuation due diligence, negotiates term sheets, and closes deals.

Harvest period: Once the investment period has expired (generally in year 5 or 6), the fund enters its “harvest period” and pivots from making new investments to growing and exiting the investments that have already been made.

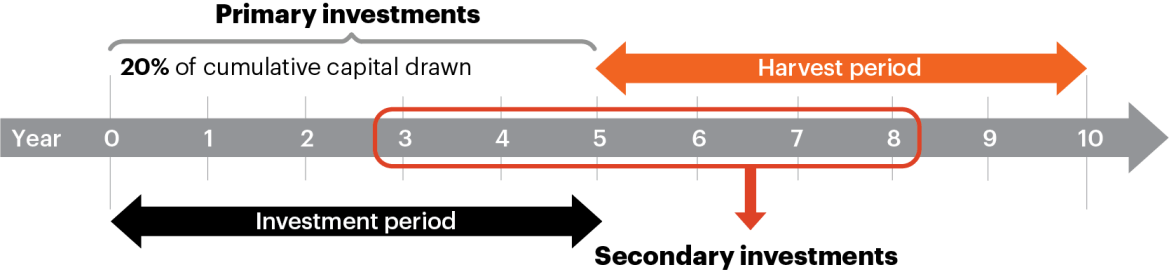

Primary vs. secondary investments

The secondary market for private equity funds and portfolio companies has grown significantly in recent years, helping general and limited partners better manage their liquidity needs while creating a meaningful opportunity set for investors.

The illustration below highlights some of the key attributes of the primary and secondary markets.

Primary investments

- Limited partners commit to a “blind pool” at the fund’s inception (year 0) and make additional investments throughout the investment period as the manager identifies new investments.

- Investors receive periodic distributions throughout the harvest period, which typically begins after year 5 or 6.

Secondary investments

- Interests in existing private equity funds or assets are sold to new limited partners (LP-led) or transferred to a continuation vehicle (GP-led), typically later in the primary fund’s life cycle.

- Secondary investors have the ability to underwrite a substantially constructed portfolio of investments and receive the distributions generated by the underlying portfolio companies.

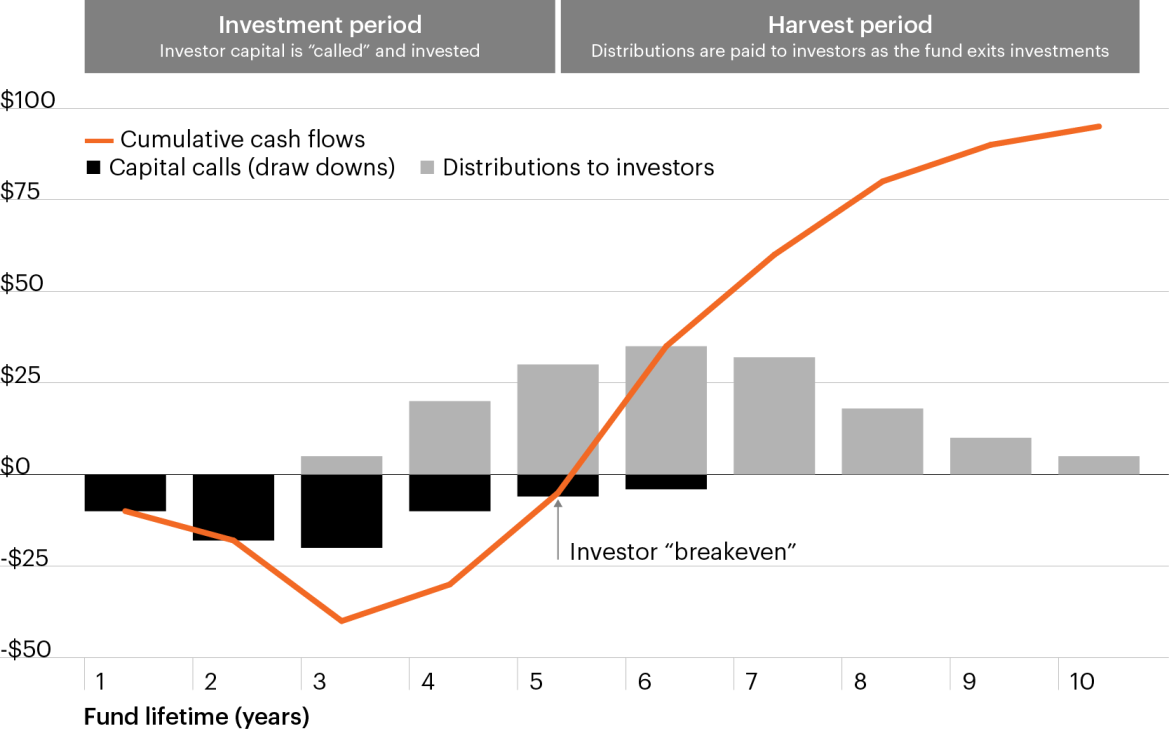

The J-curve

Understanding private equity returns

The J-Curve effect is used to describe the return profile of private equity funds over time.

Returns are typically negative in the first few years of the fund’s life cycle as the initial capital is invested and fees are paid to the general partner.

Returns begin to increase in the later years when investments are exited and distributions are paid to investors.

Vintages aren’t just for wine

A fund’s vintage year matters for performance

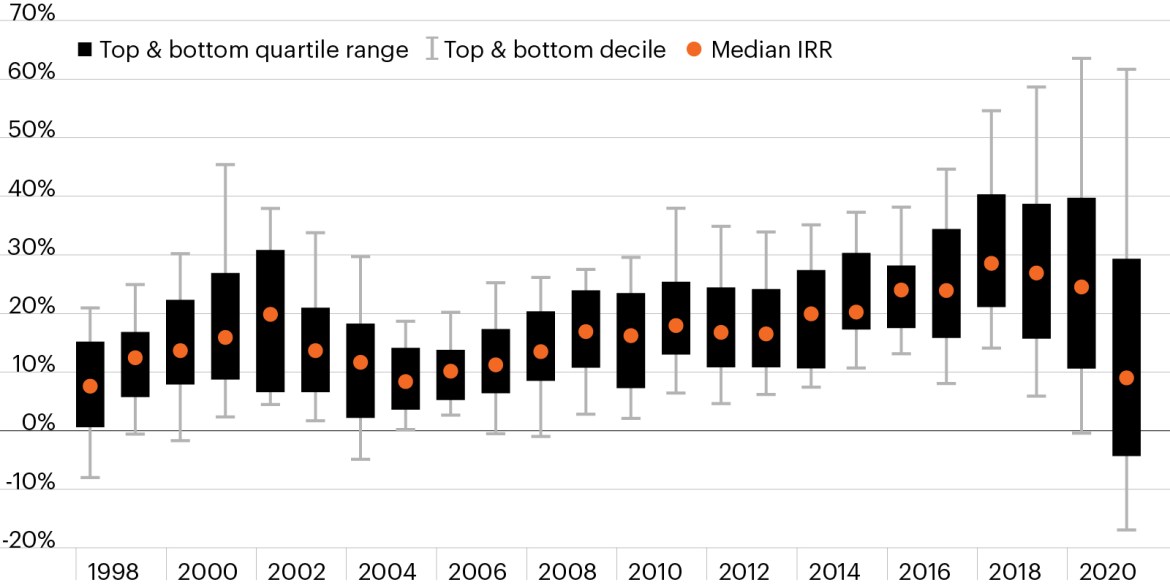

Another key term in understanding private equity investing is a fund’s vintage, which refers to the year when the fund begins making investments.

The vintage year matters for investors since market conditions and valuations in the public markets can vary significantly across different time periods. For example, private equity funds with vintages from 1998–2000, which deployed capital into the peak of the dot-com bubble, underperformed vintages from 2001–2003, which were able to invest in companies at lower valuations after the dot-com crash.

Similarly, vintages 2004–2006 deployed capital during the bull market preceding the Global Financial Crisis (GFC). These vintages tended to underperform funds that deployed capital post-GFC.

IRRs by vintage

Source: Pitchbook | Geography: North America | Data as of June 30, 2022

Importance of structure

Comparing fund structures

Private equity investing has historically been limited to large institutions and high net worth individuals due to the large minimum investments and suitability requirements of traditional PE fund structures. However, evergreen funds help address many of these operational challenges while providing the investor protections associated under the 1940 Act.

| Traditional PE funds | Evergreen funds | |

| Access | • Investment minimums usually over $5M • Qualified purchaser • Limited offering period | • Low investment minimum • Usually qualified clients • Typically monthly subscriptions |

| Capital deployment | • Multiyear commitment period • J-curve effect • Reinvestment risk • Typically a 10-year lockup • Capital calls/drawdown | • Capital is fully deployed upon investments • No capital calls • Reduced reinvestment risk |

| Tax reporting | K-1 | 1099 |

Glossary

Primary fund: Primary fund investing refers to investments made by an investor in a private equity fund during initial and subsequent closings, i.e., when capital commitments are being solicited. By making a primary fund investment, an investor participates in the fund from its inception and can realize the full benefit of gains and distributions as portfolio investments are made and realized. In addition, investors who make primary fund investments may have an opportunity to negotiate terms and conditions with the promoter of the fund, as the fund is being established.

Secondary interest: Secondary fund investing refers to the purchase of an individual fund or portfolio of fund investments, after some or all of the capital commitments of the LPs have already been called and invested. Secondary investors assume the same terms as the primary fund investor.

Investment period: The first four to five years of a private equity fund’s life is known as its “investment period.” During this time, the GP sources and evaluates potential investments, conducts business and valuation due diligence, negotiates term sheets, and closes deals.

Harvet period: Once the investment period has expired (generally in year 5 or 6), the fund enters its “harvest period” and pivots from making new investments to growing and exiting the investments that have already been made.

J-Curve: The J-curve shows the effect of the common practice of paying management fees and start-up costs out of early drawdowns before the portfolio has had time to recognize value enhancement at its underlying investments. A fund’s return begins to rise if/when it has positive portfolio realizations or write-ups in valuations.

“Blind Pool” risk: When investing in a private equity fund on a primary basis, the manager has not yet made any investments. The investors of the fund give broad discretion to the manager to make investments focused on a particular industry or strategy (buyouts, special situations, growth, venture capital, etc.). These funds are called “blind pools” because investors know little about what the fund manager will invest in at the time they make their commitment.

Investor considerations

Investing in alternatives is different than investing in traditional investments such as stocks and bonds. Alternatives tend to be illiquid and highly specialized. In the context of alternative investments, higher returns may be accompanied by increased risk and, like any investment, the possibility of a partial or total investment loss. Investments made in alternatives may be less liquid and harder to value than investments made in large, publicly traded corporations. When building a portfolio that includes alternative investments, financial professionals and their investors should first consider an individual’s financial objectives. Investment constraints such as risk tolerance, liquidity needs and investment time horizon should be determined.

This information is educational in nature and does not constitute a financial promotion, investment advice or an inducement or incitement to participate in any product, offering or investment. FS Investments is not adopting, making a recommendation for or endorsing any investment strategy or particular security. All views, opinions and positions expressed herein are that of the author and do not necessarily reflect the views, opinions or positions of FS Investments. All opinions are subject to change without notice, and you should always obtain current information and perform due diligence before participating in any investment. FS Investments does not provide legal or tax advice and the information herein should not be considered legal or tax advice. Tax laws and regulations are complex and subject to change, which can materially impact any investment result. FS Investments cannot guarantee that the information herein is accurate, complete, or timely. FS Investments makes no warranties with regard to such information or results obtained by its use, and disclaims any liability arising out of your use of, or any tax position taken in reliance on, such information.

Any projections, forecasts and estimates contained herein are based upon certain assumptions that the author considers reasonable. Projections are necessarily speculative in nature, and it can be expected that some or all of the assumptions underlying the projections will not materialize or will vary significantly from actual results. The inclusion of projections herein should not be regarded as a representation or guarantee regarding the reliability, accuracy or completeness of the information contained herein, and neither FS Investments nor the author are under any obligation to update or keep current such information.

All investing is subject to risk, including the possible loss of the money you invest.