Education > Strategies > Private equity > Accessing private equity

Accessing private equity

Why manager selection matters

Manager selection

Why selecting the right manager is key

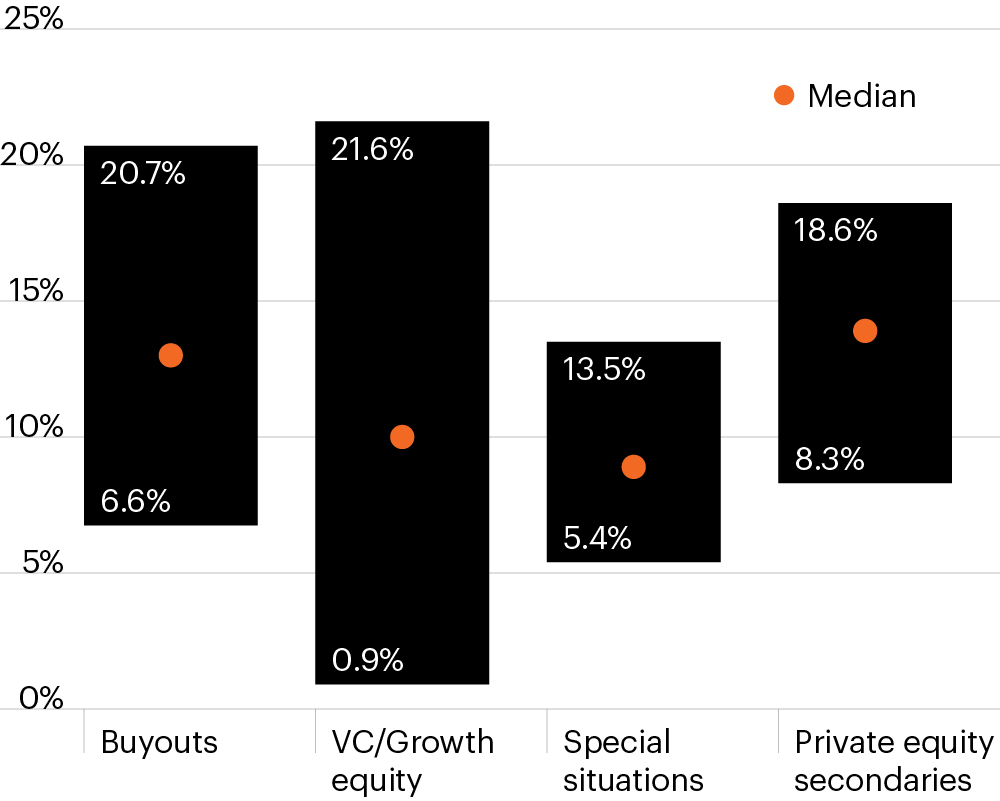

Access to top quartile managers is integral to the potential for superior performance, with top quartile managers demonstrating outperformance through multiple cycles. However, it is important to remember outperformance is not unique to one strategy and the composition of top quartile managers changes over time.

IRR for Vintage Years 1996–20171,2

Spread between top and lower quartile manager performance

Why does having access to top quartile sponsors matter?

- Historically proven outperformance through multiple cycles

- Outperformance by top quartile managers is persistent across strategies

- Composition of top quartile managers changes over time

Source: Cambridge Associates data as of March 31, 2022, “Private Equity Index and Benchmark Statistics.” There is no guarantee private equity markets or any specific private equity investment will outperform the public market or any private equity investment will be profitable and an investor could lose all or a portion of its investment therein. The use of indexes is for illustrative purposes only.

1. Excluded data on vintage years 2018, 2019 and 2020. Recent vintage year funds are considered to be immature funds.

2. Average of vintage year observations for top quartile and lower quartile performance. Past performance is not indicative of future results.

Why does having access to top quartile sponsors matter?

- Proven outperformance through multiple cycles

- Outperformance by top quartile managers is persistent across strategies

- Composition of top quartile managers changes over time

How can individuals access private equity?

In the past, traditional means of accessing private equity had high investment minimums that, in effect, barred individual investors from accessing this asset class.

Now, however, individual investors can access private equity through evergreen funds.

| Traditional PE funds | Evergreen funds | |

| Access | • Investment minimums usually over $5M • Qualified purchaser • Limited offering period | • Low investment minimum • Usually qualified clients • Typically monthly subscriptions |

| Capital deployment | • Multiyear commitment period • J-curve effect • Reinvestment risk • Typically a 10-year lockup • Capital calls/drawdown | • Capital is fully deployed upon investments • No capital calls • Reduced reinvestment risk |

| Tax reporting | K-1 | 1099 |

A dynamic partnership

FS Investments and Portfolio Advisors have combined to offer FS MVP Private Markets Fund. The fund allows investors to invest with and alongside what we consider to be the MVP sponsors of the U.S. middle market, leveraging Portfolio Advisors’ 300+ middle sponsor network to invest in sponsors and funds, which are hard to access within a fragmented market.

Investor considerations

Investing in alternatives is different than investing in traditional investments such as stocks and bonds. Alternatives tend to be illiquid and highly specialized. In the context of alternative investments, higher returns may be accompanied by increased risk and, like any investment, the possibility of a partial or total investment loss. Investments made in alternatives may be less liquid and harder to value than investments made in large, publicly traded corporations. When building a portfolio that includes alternative investments, financial professionals and their investors should first consider an individual’s financial objectives. Investment constraints such as risk tolerance, liquidity needs and investment time horizon should be determined.

This information is educational in nature and does not constitute a financial promotion, investment advice or an inducement or incitement to participate in any product, offering or investment. FS Investments is not adopting, making a recommendation for or endorsing any investment strategy or particular security. All views, opinions and positions expressed herein are that of the author and do not necessarily reflect the views, opinions or positions of FS Investments. All opinions are subject to change without notice, and you should always obtain current information and perform due diligence before participating in any investment. FS Investments does not provide legal or tax advice and the information herein should not be considered legal or tax advice. Tax laws and regulations are complex and subject to change, which can materially impact any investment result. FS Investments cannot guarantee that the information herein is accurate, complete, or timely. FS Investments makes no warranties with regard to such information or results obtained by its use, and disclaims any liability arising out of your use of, or any tax position taken in reliance on, such information.

Any projections, forecasts and estimates contained herein are based upon certain assumptions that the author considers reasonable. Projections are necessarily speculative in nature, and it can be expected that some or all of the assumptions underlying the projections will not materialize or will vary significantly from actual results. The inclusion of projections herein should not be regarded as a representation or guarantee regarding the reliability, accuracy or completeness of the information contained herein, and neither FS Investments nor the author are under any obligation to update or keep current such information.

All investing is subject to risk, including the possible loss of the money you invest.