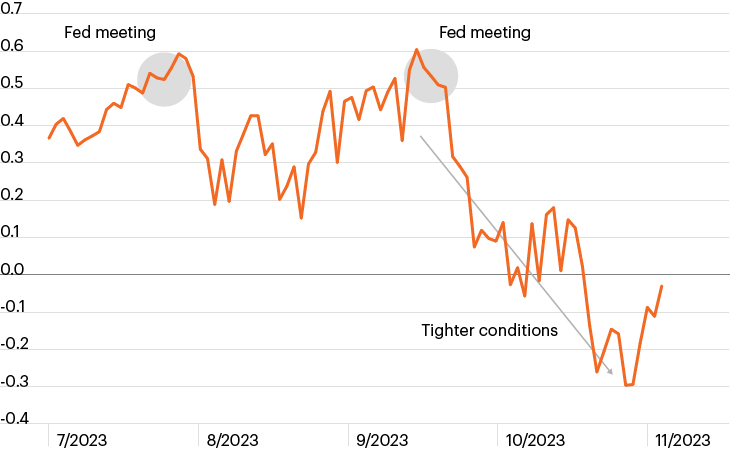

Bloomberg Financial Conditions Index

Source: Bloomberg Finance, L.P., as of November 2, 2023. The Bloomberg Financial Conditions Index gauges overall conditions in U.S. financial and credit markets; positive values indicate more accommodative financial conditions.

- Markets rallied this week upon the Federal Reserve’s perceived dovish pivot, as Chair Powell suggested the Fed may no longer need to raise rates. Powell cited tighter financial conditions, among other factors, for helping fulfill the Fed’s goal of slowing inflationary pressures.

- As policymakers seemingly eased the brake pedal a bit following one of the Fed’s fastest policy tightening regimes ever, the ensuing rally highlighted the tricky cat-and-mouse game that policymakers will likely continue to play with markets.

- Financial conditions quickly loosened this week at Chair Powell’s press conference as the chart highlights, with stocks bouncing as Treasury yields across the curve plunged.

- It was not enough to fully retrace the significant tightening that took place since late September when the Fed’s higher-for-longer messaging began to resonate with markets, pushing real yields higher and punishing core fixed income, stocks and other rate-sensitive investments.

- Yet the week’s rally highlights how quickly markets can reverse months of careful Fed messaging, complicating their efforts at tamping inflation and potentially leaving markets vulnerable to further Fed-driven rate volatility.