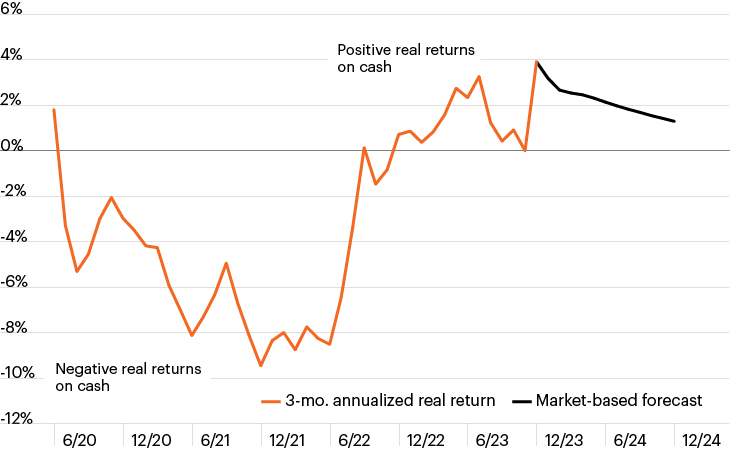

Real return on cash may have peaked

Source: Bloomberg Finance, L.P., as of December 31, 2023. Data shows the 3-monthl T-bill return minus the rate of headline CPI inflation. The market-based forecast for 2024 utilizes current Fed funds futures pricing and consensus headline CPI forecasts, as per Bloomberg.

- Following more than a decade of negative real returns on 3-month Treasury bills—capped by a painful -7.1% real return in 2022—cash became vastly more attractive in 2023, particularly at the start of the year when concerns of a recession were pervasive and base rates were elevated. Money market funds saw their assets under management balloon to $6.1 trillion last year, nearly double that of five years ago.1

- Many of the tailwinds to allocating to cash in 2023 may turn to headwinds in 2024. As the chart highlights, cash’s real return may fall throughout 2024, to well below 2% based on current Fed Funds futures curve and economists’ forecasts for CPI inflation.2

- Notably, the upside of cash also appears capped—should inflation fall more rapidly than is expected, the Fed would likely cut nominal rates more quickly; if rates were to remain higher for longer, that would imply stickier-than-expected inflation, which would eat into real returns.

- With many of the forces attracting investors to cash in 2023 reversing, investors should be mindful of the growing opportunity costs of maintaining high cash balances in today’s market.