More of our insights

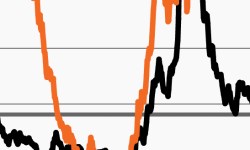

Real yields rise to usher in new market dynamics?

After two years in negative territory, real yields are back to zero. Our chart looks at real yields impact on growth and value stocks.

Research recap: Q2 2022 Corporate credit outlook

The team reviews their top five ideas for credit markets in 2022, and how they’ve played out as we kick off Q2.

Q2 2022: A balancing act

Markets face a growing list of uncertainties, but we believe that credit’s strong fundamentals should help the asset class find solid footing.

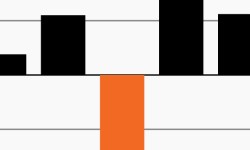

Already vulnerable, the 60/40 appears deeply challenged

The 60/40 had its worst quarter since the pandemic started. Our chart looks at quarterly returns and why the coming quarters could remain volatile.

Credit market commentary: March 2022

Sharply higher interest rates, geopolitical tensions, a volatile commodities complex, inflation, and the ultimate course of the Fed’s tightening cycle have caused volatility for much of the quarter as markets have been forced to quickly recalibrate expectations given these rapidly evolving situations.

Diverging economic forecasts as rate hikes begin?

The Fed liftoff took place as market drivers compete. This week’s chart looks at two as investors manage through an uncertain environment.