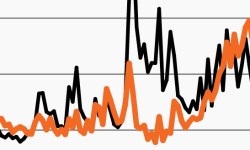

Credit performed well after previous Fed pauses

With the Fed potentially pausing after a May rate hike, this week’s chart looks at credit returns after historical pauses in Fed rate hiking cycles.

Stocks trapped in (an expensive) trading range?

Stocks have spent the last year range-bound. This week’s chart looks at the challenges they may face moving materially higher.

Family offices to increase allocation to alternatives

This week’s chart looks at institution’s growing interest in alts; they expect to grow allocations to real estate, private debt and private equity.

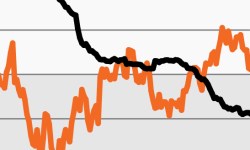

As rates reverse, a growth renaissance?

As rates plunged in March, growth stocks spiked. This week’s chart looks at the ever-shifting changing growth-value dynamics in recent years.

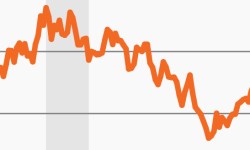

Higher credit spreads could represent unique opportunity

High yield spreads have spiked in March. This week’s chart looks at the YTD move and potential new opportunities in credit.

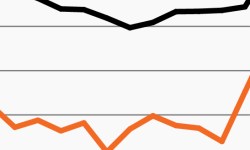

Treasury volatility hits 2008 levels amid macro pressures

Expected Treasury volatility spiked over the past week. This week’s chart looks at the MOVE Index, which rose to its highest point since 2008.