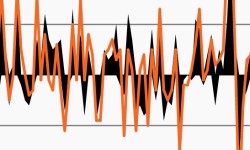

Unrelenting inflation has exaggerated rate volatility

This week’s chart looks at daily yield changes on 2-year and 10-year Treasury yields as rate volatility in 2022 has dwarfed that of last year.

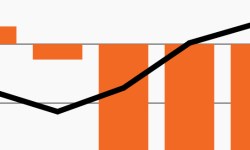

The Agg completes its worst-ever start to a year

Halfway through 2022, this week’s chart revisits the Agg’s monthly returns as expected rate volatility spikes.

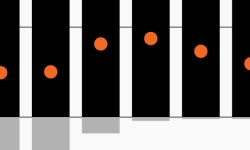

CRE debt has proven resilient during downturns

This week’s chart looks at the resilience of CRE debt during the global financial crisis, highlighting why seniority in the capital structure matters.

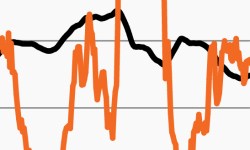

With inflation, stock-bond correlation jumps

As prices spike, this week’s chart looks at rising inflation’s impact on the correlation between stocks and bonds.

Global fixed income falters amid sustained inflation

This week’s chart looks at the global rate environment, highlighting its impact on U.S. and global core fixed income returns.

CRE debt: An overlooked fixed income asset class?

This week’s chart looks at the components of CRE debt returns since 2007, highlighting income returns, which have more than offset credit losses.