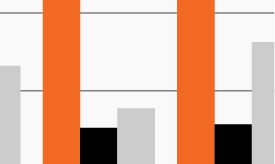

The Barclays Agg saw two very different halves in 2020

Source: Bloomberg Finance, L.P., as of December 15, 2020. Barclays Agg refers to the Bloomberg Barclays U.S. Aggregate Bond Index.

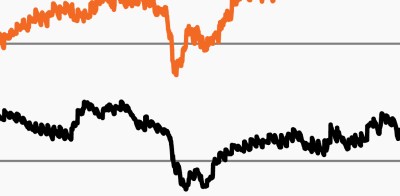

- With YTD returns of 16.4% and 7.1% for the S&P 500 and Barclays Agg, respectively, 2020 was another banner year for the 60/40 portfolio, which refers to a 60% allocation to equities (growth) and 40% to traditional bonds (income).1

- Backed by significant vaccine and economic optimism, equity investors remain upbeat about the prospects for another strong year in 2021. The outlook for traditional bonds, however, looks notably murkier as the main driver behind their strong returns of the past several years—declining interest rates—may have reached an inflection point in 2020.

- The chart looks at the YTD return for the Barclays Agg, breaking it down into the first and second half of the year. It highlights the tight spot traditional bond investors find themselves in today, as more than 85% of the Agg’s YTD return came from January to June, when interest rates plunged from low to historically low.1

- Returns have sputtered in the second half of this year, though, as the yield on the 10-year U.S. Treasury has seen a mild increase of a little less than 50 basis points and looks set to end the year just under the 1% mark. If the 10-year yield increases just another 0.50%, the Agg would experience losses of approximately 3%—completely wiping out income returns.1

- The Agg’s two very different halves this year underscore the conundrum for fixed income investors. Traditional bonds offer investors minimal income but also have little prospect for further price gains, given the still-very-low rate environment.