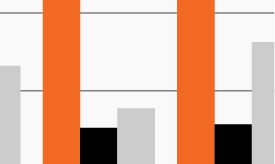

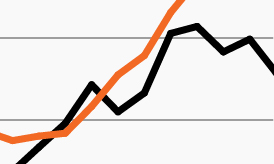

Agg return by month and 10-Year U.S. Treasury yield

Source: Bloomberg Finance L.P., as of February 10, 2022. Agg refers to the Bloomberg U.S. Aggregate Bond Index.

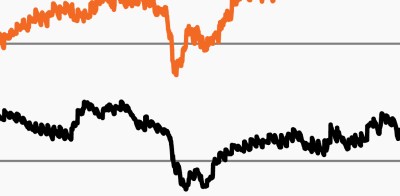

- Thursday’s inflation data caught markets by surprise and added fuel to the fire of challenges for investors— especially within long-duration, traditional fixed income.

- Since the start of 2022, the 10-Year U.S. Treasury yield has risen by approximately 51 bps, topping 2.0% this week for the first time since mid-2019.1 The sudden spike has negatively impacted core fixed income returns.

- As the chart shows, the Bloomberg U.S. Aggregate Bond Index (the Agg) has generated negative returns in five out of the last eight months and appears on track to make it six out of nine.1 The Agg had its worst monthly performance in January (-2.15%) since November 2016.1

- Inflationary pressures have broadened and accelerated this year. Markets are now pricing in more than six rate hikes in 2022, with about even odds of a 50 basis-point rate hike in March.1

- The strong wind that was at fixed income investors’ backs for much of the past four decades has begun blowing more firmly in the opposite direction.

- Against this backdrop, the search for alternative sources of income and return is perhaps more needed today than at any time over the last 10 years, given significant downside risks if rates rise further and limited upside if rates fall given the still low starting point for yields.