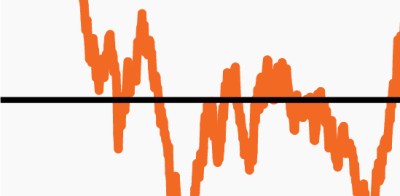

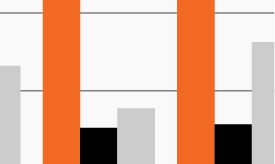

Real returns amid periods of heightened inflation

Source: Bloomberg Finance, L.P. and FS Investments. The Agg refers to the Bloomberg U.S. Aggregate Index. Data include periods between December 1998 and December 2021 when CPI rose above the mean by one standard deviation or more. Periods include April 1998–March 2000; March 2004–October 2005; October 2006–August 2008; and December 2010–September 2011; excludes current inflationary surge that began in April 2021.

- Markets reacted strongly to Thursday’s consumer price index (CPI) release as inflation hit another four-decade high and is still on the rise. Peak inflation projections continue to get pushed out as the war in Ukraine raises the possibility that prices could see upward pressure for the foreseeable future.

- Against a backdrop of unrelenting inflation, the 10-year U.S. Treasury yield jumped, breaching 2.0% again, while stocks quickly gave up much of the previous day’s gains.

- As the chart highlights, inflation has historically not been kind to real returns on traditional assets. Both the S&P 500 and the Agg have generated negative real returns in three of the four periods of elevated inflation highlighted since 1998 and median real returns on both indexes during the periods are solidly negative.1 While the chart doesn’t account for the current spike in inflation as it hasn’t peaked yet, total returns on the Agg and S&P are -4.3% and -10.0%, respectively, year to date.1

- U.S. inflationary pressures remain broad and don’t yet show many signs of relief. Within this environment, investors’ need for more alternative assets beyond the 60/40 portfolio may only be increasing as they search for inflation-adjusted returns.