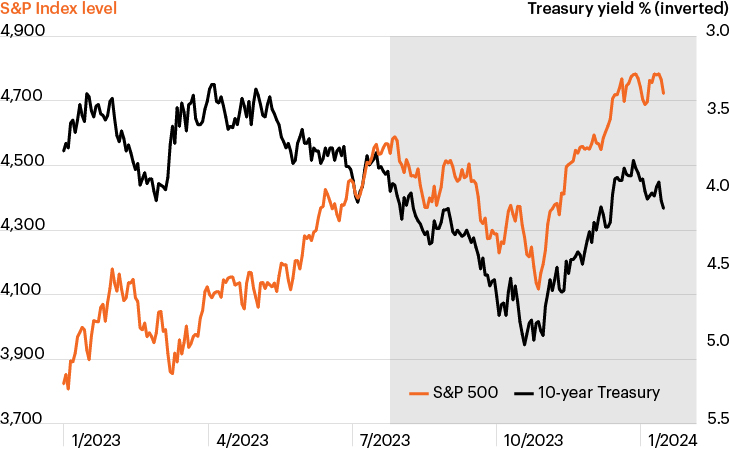

Stocks moved with rates since Q3 2023

Source: Bloomberg Finance, LP, as of January 17, 2024.

- Market conditions in the early weeks of 2024 have been almost opposite those that closed out 2023. In Q4 2023, markets spiked as investors grew increasingly certain that the Fed would cut rates as the soft-landing narrative took hold. In the first few weeks of January, stocks have retreated as solid economic data cast doubt on the direction of monetary policy.

- Despite markets’ different paths in Q4 and the early stages of Q1, the primary driver across both environments has been the same: Treasury yields.

- As the chart shows, the S&P 500’s movements since the second half of 2023 have almost entirely aligned with those of the 10-year U.S. Treasury yield (black line, inverted).

- Stocks’ rate sensitivity was a clear tailwind through most of the past year, but it has recently shown signs of turning into a headwind as rates’ forward path remains uncertain amid solid economic data and several Fed policymakers questioning the need for near-term rate cut rates.

- Against this backdrop, it is important for investors to remain aware of stocks notably elevated rate sensitivity, including seeking alternative sources of diversification and total return as stock-bond correlation remains high.