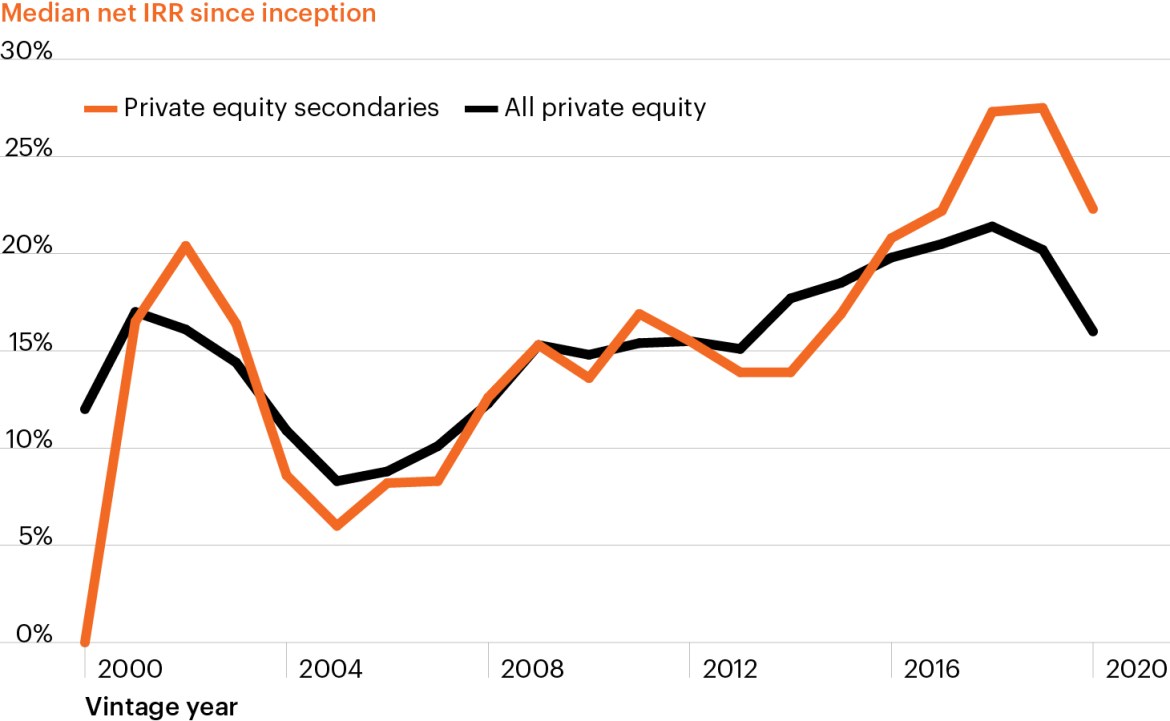

Performance gap widens for secondaries

Source: Preqin Global Report 2024: Private Equity, June 30, 2023.

- Private equity (PE) assets under management have grown exponentially over the past decade as investors increasingly seek diversified sources of growth outside of public markets.

- The growth in the PE market has created demand from general partners (GPs) and limited partners (LPs) alike for a deeper and more active secondary market to help market participants manage liquidity needs.

- As this week’s chart shows, private equity secondary funds have outperformed the broader private equity fund universe in recent years driven by strong underlying portfolio company performance and attractive pricing discounts as supply has outweighed available investor capital, among other factors.1

- In addition to strong absolute and relative returns, PE secondaries have exhibited low correlation to stocks, bonds and primary PE funds.2 This can, in part, be attributed to the countercyclical attributes of PE secondary funds as traditional paths for exiting primary fund interests (e.g., IPOs and strategic buyers) may be less viable during periods of market volatility, raising the “liquidity premium” PE secondary investors may earn.

- When combined in a portfolio, secondaries may provide a single-point-of-entry for diversification across PE strategies, sectors and vintage years, while retaining exposure to the core value drivers of private equity.