After Fed liftoff, fundamentals take center stage

As the Fed commences a new round of rate hikes, our chart looks at maximum compression in price/earnings (P/E) ratios amid historical rate hike cycles.

Inflation wreaks havoc on traditional assets

Amid another record CPI print, this week’s chart looks at the S&P 500 and the Agg’s historical returns during periods of elevated inflation.

Balance returning after a decade of U.S. outperformance?

The investment opportunity set has changed in 2022. This week’s chart looks at signs of balance between U.S. and international stocks.

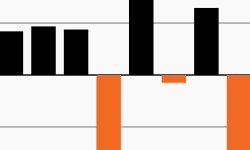

The 60/40 starts 2022 in the red

This week’s chart looks at the monthly returns on the 60/40 portfolio, which declined in January and faces a murky outlook in 2022.

A sharp rotation toward value as rates rise

Value dominates early 2022 as rates rise. Our chart looks at value’s relative outperformance and why flexibility may be key this year.

Equities, and expected rate volatility, bounce together

Expected equity volatility quickly settled though it continued to climb in the rates market. Our chart revisits the divergence.