More of our insights

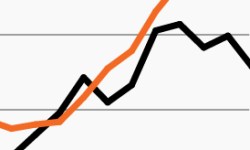

Private credit maintains its healthy yield premium

Amid private debt’s massive growth, this week’s chart looks at the healthy yield premium of private credit transactions compared to public markets.

FireSide: Market Madness 2024

In celebration of March Madness, the Investment Research team goes head-to-head discussing leading topics set to influence markets this year.

Awakening: The rise of private debt

Private debt has grown from niche asset class to a heavyweight due to multiple structural shifts in capital markets—and its growth has shifted the opportunity set for both investors and borrowers.

Charted territory: Buy the bushel, but beware of bad apples

After relatively benign credit conditions following the pandemic, dispersion of loan issuer quality is growing. Read more in our Q1 corporate credit playbook.

FireSide: Q4 2023 Research roundtable—Can the growth continue?

Our experts dive in to the latest in commercial real estate, corporate credit and macroeconomic trends.

A focus on duration amid the nonstop rise in rates

This week’s chart looks at high yield bonds’ limited duration profile compared to investment grade bonds.