More of our insights

Credit market commentary: July 2023

Credit markets experienced continued positive momentum in July amid positive economic data, moderating inflation and better-than-expected Q2 earnings reports.

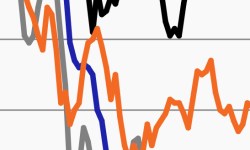

In 2023, the Agg has seen little bounce-back

The Agg has lost steam with three consecutive monthly declines. This week’s chart tracks its monthly returns against the 10-year yield.

FireSide: Q3 2023 Research roundtable—Rethink what you know

The Investment Research team offers their outlooks for macro, credit markets and commercial real estate.

Credit market commentary: June 2023

Driven by stronger than expected economic data in June, credit markets turned higher as senior secured loans returned 2.26% while high yield bonds returned 1.63%.

Q3 2023 Corporate credit outlook: Can the good times roll?

Markets have displayed almost unwavering strength year to date (YTD). Fundamentals remain sound, but challenges await.

Credit attractive compared to expensive stocks?

Stocks remain expensive and credit markets may offer an attractive alternative. This week’s chart looks at diverging valuations over time.