More of our insights

Is private credit a bubble?

Private credit has grown in both size and breadth, prompting questions around the risks of the asset class and whether it could represent a bubble. We address those concerns in this note.

FireSide: Answering the burning questions around private debt – Part 1

Private debt is a rapidly expanding market that has become critical for the U.S. economy and an opportunity for investors. In Part 1, we discuss the fundamentals of the market and trends driving its growth.

Private credit attractive to sponsors and investors

Private credit has become PE sponsors’ primary source of financing for LBOs and M&A activity as the asset class becomes increasingly mainstream.

Q2 2024 Corporate credit outlook: Drafting down the straightaway

Continued economic stability has fostered healthy fundamentals in most leveraged credit, but risks are accumulating in loans to lower-rated private borrowers.

FireSide: Q2 2024 Research roundup—Adjusting to the old normal

Our experts dive into their outlooks for macro and markets in the second quarter.

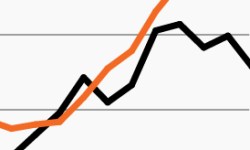

Private credit maintains its healthy yield premium

Amid private debt’s massive growth, this week’s chart looks at the healthy yield premium of private credit transactions compared to public markets.