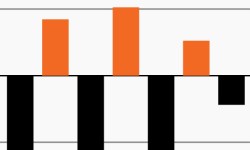

Competing data confound markets again

Retail sales data and sentiment moved in opposite directions. This week’s chart looks at the divide, why the competing data could drive volatility.

Hawkish Fed to remain a challenge in 2023?

Markets don’t seem to believe Fed policy makers. This week’s chart looks at why market-based Fed funds rate expectations could drive volatility.

A challenging tightrope walk for the Fed gets harder

Financial conditions and markets have danced closely together this year. This week’s chart looks at why their latest move may be problematic for the Fed.

As inflation cools, macro alarms sound anew

The 10Y–2Y yield curve inverted to its deepest level in 40 years. This week’s chart looks at the yield curve over time as macro risks remain prominent.

Could a tight housing market mean opportunity in CRE?

Mortgage rates have hit a new high as housing inventory remains depressed. This week’s chart looks at why this could buoy multifamily CRE.

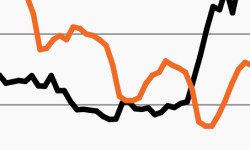

The Agg is no longer balancing equity volatility

As rates keep rising, this week’s chart looks at the 60/40’s historically poor performance, as the Agg has not balanced stocks’ negative returns.