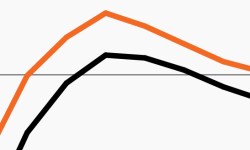

Negative productivity complicates the Fed’s path

Though CPI moderated in July, this week’s chart looks at negative productivity trends that could exaggerate wage pressures and complicate the Fed’s job.

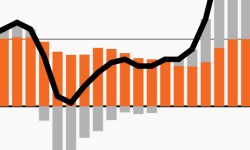

Inflation to stick with us for a while longer?

This week’s chart looks at the makeup of inflation this year, noting it has become a stickier problem in recent months.

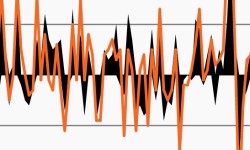

Unrelenting inflation has exaggerated rate volatility

This week’s chart looks at daily yield changes on 2-year and 10-year Treasury yields as rate volatility in 2022 has dwarfed that of last year.

Global fixed income falters amid sustained inflation

This week’s chart looks at the global rate environment, highlighting its impact on U.S. and global core fixed income returns.

A battle emerges between sentiment and earnings

Eroding sentiment has driven markets down, yet fundamentals remain firm. This week’s chart looks at the divergence, why it could drive volatility.

Investors bracing for a potential policy mistake?

Investors expecting rapid rate hikes, followed by a quick reversal? Our chart looks at market expectations for a possible policy mistake.