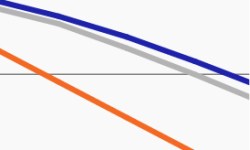

Cash attractiveness may have peaked in 2023

Cash was an attractive, safe asset last year amid elevated rates. This week’s chart looks at why the tide may be changing.

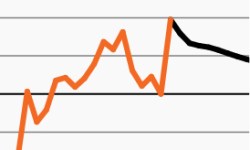

Will a rate-dependent equity market become a headwind?

Could last year’s market tailwind turn into this year’s headwind? This week’s chart looks at stocks and rates’ tandem moves over the past year.

Equity market to remain rate dependent in 2024?

This week’s chart finds the bulk of the S&P’s returns last year came on days when rates fell. So far, 2024 has followed a similar pattern.

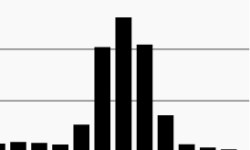

Stock-bond correlation hits multi-decade high

Stock-bond correlation spiked in 2023 to a 40-year high. This week’s chart looks at how it exacerbates the diversification challenge.

Private CRE debt offers a hefty yield premium to cash

This week’s chart looks at private CRE debt’s notable yield premium to cash, even as cash yields are elevated.

Markets pricing in too much Fed easing?

Is the market expecting too much from the Fed? This week’s chart looks at the dramatic decline in market-based rate expectations.