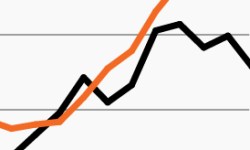

Middle market companies tripled growth of large cap peers

Middle market private equity sponsors have historically provided outsized value compared to their large cap peers.

Outlook for private equity return drivers favor middle market?

This week’s chart looks at return drivers for middle market buyout transactions, which have generated higher realized capital multiples than large cap and may favor middle market managers looking forward.

Private credit maintains its healthy yield premium

Amid private debt’s massive growth, this week’s chart looks at the healthy yield premium of private credit transactions compared to public markets.

With investor sentiment stretched, time to diversify?

This week’s chart looks at the spread between bullish and bearish investors, which has widened significantly in the past several months.

A compelling growth opportunity in private equity secondaries?

This week’s chart looks at private equity secondaries’ outperformance versus the broader PE market, focusing on what has driven the outperformance.

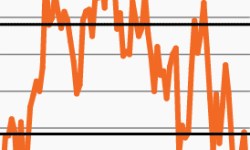

Private and public company earnings taking divergent paths

This week’s chart looks at a shifting opportunity set as the private middle market shines while small cap company earnings remain challenged.